Weekly Market Insights | November 11th, 2024

Stocks Surge Post-Election; Fed Cuts Quarter Point

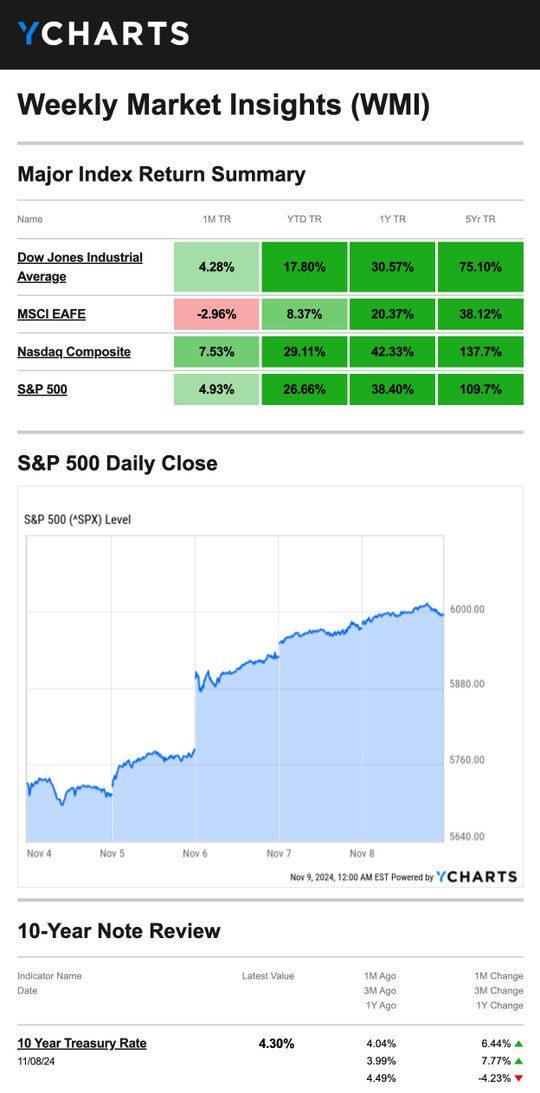

Stocks surged higher last week, fueled by the Fed’s rate cut decision and post-election enthusiasm as investors looked to future policy impacts of a Republican-controlled Senate and executive branch. (The House of Representatives remains undecided.)

The Standard & Poor’s 500 Index spiked 4.65 percent, while the Nasdaq Composite Index gained 5.74 percent. The Dow Jones Industrial Average rose 4.61 percent. The MSCI EAFE Index, which tracks developed overseas stock markets, was flat (-0.02 percent).1,2

Stocks Extend Rally on Election News

It was a shaky start to the week for stocks as investors anxiously awaited election results and the Fed’s interest-rate decision.3

On Election Day, stocks rallied broadly before polling places closed. After the election was called early the next morning, stocks opened higher and climbed throughout the trading session. The yield on the 10-year Treasury fell to 4.307 percent.4,5

Stocks opened higher Thursday, and the rally picked up momentum after the Federal Reserve approved its second consecutive interest rate cut. Economic news that showed a 2.2 percent rise in third-quarter productivity helped support the move.6,7

Stocks finished the week with a number of records: the S&P 500 crossed the 6,000 mark, and the Dow breached 44,000 for the first time on Friday. While the S&P and Dow closed slightly below those record levels, each had their best week in a year.8

|

|

Fed Cuts Rates

As expected, the Federal Reserve cut interest rates by a quarter percentage point at its November meeting.

However, Fed Chair Jerome Powell signaled some uncertainty about the pace of future rate cuts, which slightly unsettled the markets.

Citing a desire to “steer between the risk of moving too quickly and perhaps undermining our progress on inflation, or moving too slowly and allowing the labor market to weaken too much,” Powell said the Fed will continue to monitor the economy’s progress.9

This Week: Key Economic Data

Tuesday: Fed Officials Neel Kashkari and Patrick Harker speak.

Wednesday: Consumer Price Index. Fed Officials Lorie Logan, Alberto Musalem, and Jeffrey Schmid speak. Treasury Buyback Announcement.

Thursday: Producer Price Index. Fed Chair Jerome Powell speaks. Weekly Jobless Claims.

Friday: Retail Sales. Industrial Production. Import and Export Prices. Business Inventories.

Source: Investors Business Daily – Econoday economic calendar; November 8, 2024

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

This Week: Companies Reporting Earnings

Tuesday: The Home Depot, Inc. (HD), Shopify Inc. (SHOP), Spotify Technology (SPOT)

Wednesday: Cisco Systems, Inc. (CSCO)

Thursday: The Walt Disney Company (DIS), Applied Materials, Inc. (AMAT), Brookfield Corporation (BN)

Source: Zacks, November 8, 2024.

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.

Food for Thought…

“Many men go fishing all of their lives without knowing that it is not fish they are after.”

– Henry David Thoreau

Tax Tip…

Be On the Lookout for Tax Carryovers

Deductions or credits not used fully one tax year that may be eligible to be carried over into future years include:

- When you have a net operating loss

- When your total expenses for a permitted deduction exceed the amount you’re allowed to deduct in a given year

- When a credit you qualify for exceeds the amount of tax you owe in a year

- Adoption tax credits

- Foreign tax credits

- Credits for energy efficiency

Track these (or have your software do it) so you don’t forget them from one year to the next.

This information is not a substitute for individualized tax advice. Please discuss your specific tax issues with a qualified tax professional.

Tip adapted from IRS10

Healthy Living Tip…

Know Your Key Health Numbers

According to the American Heart Association, adults should know their key health numbers, including total cholesterol, HDL (good cholesterol), blood pressure, blood sugar, and body mass index. If you’re unsure what your “numbers” are, schedule a visit with your doctor to monitor them and understand why each is important. Here’s a quick definition of each metric:

- Cholesterol – Cholesterol is a lipoprotein in our body’s tissues that forms and maintains cell membranes.

- Body mass index (BMI) – Your BMI is calculated using your height and weight and can help determine whether you’re underweight, at a healthy weight, or overweight.

- Blood pressure – Blood pressure refers to the amount of force the heart must use to pump blood throughout the body.

- Blood sugar – Blood sugar measures the concentration of glucose in the blood.

Tip adapted from American Heart Association11

Weekly Riddle…

What common English-language word becomes shorter when you make it longer?

Last week’s riddle: I am only one syllable long and too heavy for one person to lift, but if you reverse me, I am not. What am I?

Answer: A ton.

Photo of The Week…

Gateway Arch

Saint Louis, Missouri

,

Footnotes And Sources

1. The Wall Street Journal, November 8, 2024

2. Investing.com, November 8, 2024

3. CNBC.com, November 4, 2024

4. CNBC.com, November 5, 2024

5. The Wall Street Journal, November 6, 2024

6. The Wall Street Journal, November 7, 2024

7. MarketWatch.com, November 7, 2024

8. The Wall Street Journal, November 8, 2024

9. The Wall Street Journal, November 7, 2024

10. IRS.gov, January 30, 2024

11. American Heart Association, July 24, 2024

Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost.

The forecasts or forward-looking statements are based on assumptions, may not materialize, and are subject to revision without notice.

The market indexes discussed are unmanaged, and generally, considered representative of their respective markets. Index performance is not indicative of the past performance of a particular investment. Indexes do not incur management fees, costs, and expenses. Individuals cannot directly invest in unmanaged indexes. Past performance does not guarantee future results.

The Dow Jones Industrial Average is an unmanaged index that is generally considered representative of large-capitalization companies on the U.S. stock market. Nasdaq Composite is an index of the common stocks and similar securities listed on the NASDAQ stock market and is considered a broad indicator of the performance of technology and growth companies. The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI) and serves as a benchmark of the performance of major international equity markets, as represented by 21 major MSCI indexes from Europe, Australia, and Southeast Asia. The S&P 500 Composite Index is an unmanaged group of securities that are considered to be representative of the stock market in general.

U.S. Treasury Notes are guaranteed by the federal government as to the timely payment of principal and interest. However, if you sell a Treasury Note prior to maturity, it may be worth more or less than the original price paid. Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors.

International investments carry additional risks, which include differences in financial reporting standards, currency exchange rates, political risks unique to a specific country, foreign taxes and regulations, and the potential for illiquid markets. These factors may result in greater share price volatility.

Please consult your financial professional for additional information.

This content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. This material was developed and produced by FMG Suite to provide information on a topic that may be of interest. FMG is not affiliated with the named representative, financial professional, Registered Investment Advisor, Broker-Dealer, nor state- or SEC-registered investment advisory firm. The opinions expressed and material provided are for general information, and they should not be considered a solicitation for the purchase or sale of any security.

Copyright 2024 FMG Suite.